Limited Company BTL – Zero Personal Guarantee Required

Personal guarantees are (mostly) compulsory.

What is a Personal Guarantee?

With a homeowner mortgage or personal-name Buy-to-Let, you always guarantee the loans in your name.

However, with Limited Companies being their own legal entity, providing shareholders with "limited liability", this poses a high risk to mortgage lenders. Therefore, a mortgage lender will require the LTD Company BTL Shareholders and/or Directors to sign a Personal Guarantee, holding you personally accountable if you fail to pay the mortgage.

When is a Personal Guarantee required?

Personal guarantees are (mostly) compulsory in most circumstances.

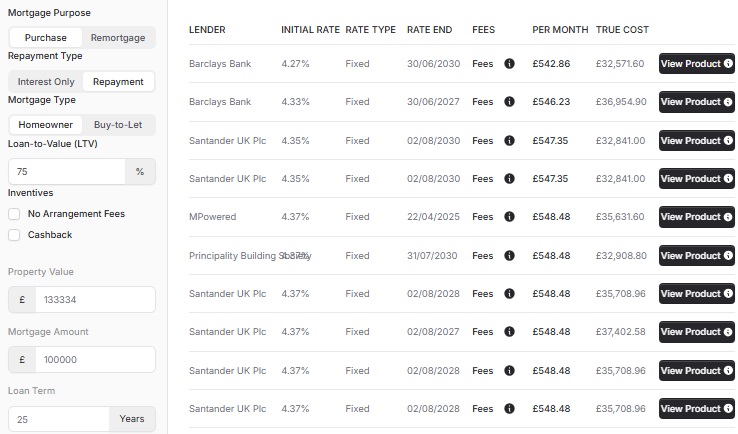

However, exceptions do exist. A select few lenders waive the requirement in exceptional cases where the Loan-to-Value (LTV) ratio is very low (55% LTV or lower). The lender must be confident that the risk is low and, in the event of a default, recoup the funds from the company's assets.

Asking a lender to take a risk by lending you the money, but requesting that you do not personally risk your personal wealth - Always raises questions.

In addition, if you do pass the criteria, you should ask yourself - how much of a premium would you pay for a mortgage without personal guarantees? Ask your Mortgage Adviser for a comparable quote.

What Does This Mean for You?

The lender requires a minimum deposit as a safety buffer first. However, a personal guarantee is a backstop in case the asset depreciates or payments are missed. The personal guarantee is released upon full repayment to the lender (e.g., by selling the property).

A personal guarantee gets around the "limited liability" that an LTD Company typically offers and puts you, the shareholder/director, on the line for the debt.

Allowing a mortgage lender to assess your circumstances, your income and your assets. It has reassured them that in the event of a default, they can pursue any unpaid amounts from you.

As a general rule, the few lenders that offer "no personal guarantee BTL Mortgages" will require 55% LTV or lower. With significant equity in the property, the lender can be confident they will recover their funds in the event of a default.

REF: {1SFN}

-

Buy-to-Let Criteria

>

Navigate the world of property investment confidently with our Buy-to-Let Criteria, ensuring you meet the standards for unlocking lucrative opportunities.

-

Buy-to-Let Affordability

>

Achieve investment success with Buy-to-Let Criteria Affordability, ensuring your property ventures align seamlessly with your financial capabilities.

-

Buy-to-Let Minimum Deposit

>

Your Guide to the Minimum Deposit required to get into Buy-to-Let.

-

Buy-to-Let for First Time Buyers

>

Embark on your property investment journey confidently with Buy-to-Let for First Time Buyers, tailored to guide newcomers towards their first lucrative investment.

-

Buy-to-Let Personal Guarantee

>

Your Guide to Personal Guarantees and Buy-to-Let.

Get in touch

We are your online mortgage broker, offering you the convenience of applying for a mortgage online. However, we understand that sometimes you may prefer to speak with a human - phone, email or in person.

- Phone number

- 01133 205 902

- [email protected]

- Postal address

-

31 Bradford Chamber Business Park,

New Lane, Bradford, BD4 8BX

Looking for career in Mortgage Advice? View job openings.

We are authorised and regulated by the Financial Conduct Authority (No. 919921). The FCA does not regulate most Buy to Let mortgages.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage.

Cyborg Finance Limited is registered in England and Wales (No. 12131863) at Bradford Chamber, New Lane, Bradford, BD4 8BX